National Data

Market Report No. 6 by the Initiative Unternehmensimmobilien

Market Report No. 6 by the Initiative Unternehmensimmobilien

Despite growing investor interest in Unternehmensimmobilien – a distinct asset class of German multi-use and multi-let commercial properties – the transaction volume in this market segment dropped to 1.84 billion euros by the end of 2016, implying a year-on-year decline by 22 percent. The trend is attributable to the shortage in investment opportunities that characterises the situation on Germany's commercial real estate market as a whole. In a parallel development, owner-occupiers are increasingly switching to lease solutions, often securing their premises for extended lease terms.

I. Investment Market 2016

In 2016, transaction volumes have become more evenly distributed among the various Unternehmensimmobilien categories. For the time being, business parks remain in the lead with an investment volume of nearly 530 million euros. But they also represent the category with the sharpest decline in capital committed. The big-ticket portfolio transactions that characterised the market in 2015 were the exception rather than the rule last year. Investments currently focus more on existing building stock to bridge the ongoing shortage in investment-grade assets.

The business parks were closely trailed by transformation properties and light manufacturing properties with total volumes of 469 and 462 million euros, respectively. Next in line were warehouse/logistics properties with a sales volume of 379 million euros. This is unsurprising in the sense that it has traditionally been the category with the lowest transaction volume. The underlying reason is mainly that only warehouse/logistics properties up to a size of 11,000 sqm are grouped with Unternehmensimmobilien. Properties larger than that are classified as large-scale logistics, which is a separate asset class.

Institutional Funds are clearly the Dominant Buyer Group

Institutional funds were by far the fastest-buying investor group in 2016. They invested roughly 760 million euros in Unternehmensimmobilien last year. Asset managers and public property companies lagged far behind at 251 and 228 million euros, respectively. The high management costs associable with it and the specialised know-how it requires make the performance of this property type hard to predict for market newcomers – and imply an obvious advantage for specialised players like institutional funds, public property companies, and asset managers.

A striking aspect not just of the second half of 2016 but of the year as a whole is the ratio of acquisitions to disposals among owner-occupiers. The latter bought 111 million euros worth of Unternehmensimmobilien in 2016, but sold properties worth 335 million euros during the same period. The trend reflects a growing inclination among corporates to divest themselves of their property stock and to switch to lease solutions instead. However, the supply in lease solutions is particularly low in regions outside the economically strong conurbations, so that companies in such regions often have no choice but to keep or buy proprietary real estate.

Yields declined in reverse proportion to increased demand. While Unternehmensimmobilien were still eyed with scepticism just a few years ago because of poor market transparency, it is now safe to say that the asset class has emerged from its niche for good. The shift has obvious consequences for the yields you may expect. For one thing, charging risk premiums is no longer the option that it used to be. The yield rates now quoted for certain top assets are on a level with the rates familiar from the asset classes office, retail or logistics. This is true particularly for the easy-to-trade multi-tenant categories of converted properties and business parks.

Compared to 2015, yields compressed in all Unternehmensimmobilien asset categories last year, meaning both average and prime yields. The gross initial yield averaged between 8 percent and close to 9 percent in 2016.

II. Occupier Market 2016

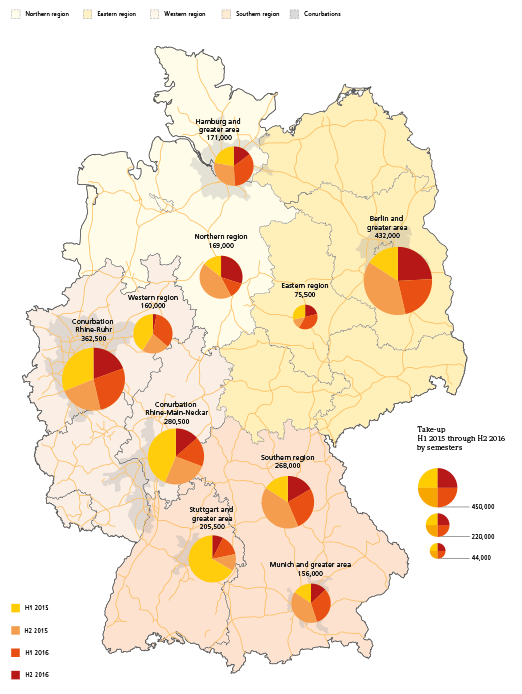

The demand for rental space in Unternehmensimmobilien assets remains high, being driven by Germany's then-as-now stable economic growth and the high employment rate that comes with it. But lettings actually declined last year. In fact, the take-up of roughly 388,000 sqm undercuts the average year-end total of the past three years by around 30 percent. The main reason is, again, the short supply in available floor space.

While the take-up dropped in virtually all regions during H2 2016 when compared to the first half-year, the Northern Region (north-western Germany, not including the greater Hamburg area) and the greater Berlin area reported positive growth. The fastest growth was registered in the Northern Region after a 147 percent surge compared to the first half of 2016. Conversely, the steepest decrease in demand was reported from the Western Region (comprising the western German states, but excluding the conurbations Rhine-Ruhr and Rhine-Main-Neckar). Compared to the mid-year figure, take-up in this region dropped by about 91 percent.

In general, it remains safe to say that demand for Unternehmensimmobilien premises is strongest for smaller units. This could be interpreted as sign for a growing desire among businesses to be more flexible. By contrast, the take-up in large premises of 10,000 sqm or more declined noticeably.

There is a manifest trend toward very long lease terms. As far as the long-term average goes, most units are let on leases for five to ten years. The trend was confirmed in H2 2016, when leases for this length of time made up roughly one quarter of the take-up. Moreover, the past semester saw a lively demand for very long leases for over ten years. Over 19 percent of the demand belonged in this segment where leases over terms of up to 20 years were signed.

However, almost one third of all lease signings during H2 2016 were for terms of less than two years, and the bulk of these were actually negotiated for less than one year (+9.5 percent). They includes storage boxes for private and small businesses.

Flex-Space Units Fall Short of Demand

The flex-space type of unit permits easy adjustments to the floor plan structure to suit bespoke occupier needs. Demand for it is particularly keen among commercial tenants in Germany's metro regions. But accommodation of this kind is in short supply, with comparatively few new-build developments in the pipeline. The main target groups for this type of property include retail companies and business service providers.

The short supply in available premises has put flex space rents under pressure. Prime rents in this segment have been going up steadily for several semesters now, gaining by more than 1.20 euros/sqm or nearly 10 percent since H1 2013. Unlike prime rents, however, the average rates for flex spaces are currently subject to a price correction, which should not be understood as a market downturn. Between the end of 2015 and mid-year 2016, rents jumped up by 2.50 euros/sqm. This was followed by a market adjustment during the second half-year of 2016. Average flex space units are currently quoted at c. 7.00 euros/sqm.

What are Unternehmensimmobilien?

The term “Unternehmensimmobilien” refers to mixed-use commercial properties, typically with a tenant structure comprising medium-sized companies. Types of use normally include offices, warehouses, manufacturing, research, service, and/or wholesale trade, and open areas. Unternehmensimmobilien break down into four real estate categories, these being converted properties, business parks, light manufacturing properties, and warehousing/logistics assets. All four of these categories are characterised by alternative use potential, reversibility of use, and a general suitability for multi-tenant structures.

About the Initiative Unternehmensimmobilien

At the moment, the Initiative Unternehmensimmobilien consists of thirteen market operators. The real estate companies represented by the Initiative have recently been joined by a corporate member, Siemens Real Estate. Their joint goal is to enhance the transparency in the market segment in order to facilitate access to the asset class. For this purpose, a reporting system was set up in collaboration with the independent research and consultancy firm of bulwiengesa, which evaluates all of the transaction and letting data that are made available by the members. With the publication of its market reports, the Initiative Unternehmensimmobilien contributes to the ongoing effort of enhancing transparency, and of familiarising a wider audience with this heterogeneous property type. At the same time, it makes the fundamental ratios it identifies available to experts and players active in this specific market. Another goal of the Initiative is to encourage SMEs and industrial companies with proprietary real estate holdings to open up and engage the market.

The INITIATIVE UNTERNEHMENSIMMOBILIEN continues to evolve. Visit us on the internet at unternehmensimmobilien.net to stay up to date.

Contact: Tobias Kassner, kassner [at] bulwiengesa.de, Phone +49 (0)40 - 4232 2220