National Data

Market Report No. 5 by the Initiative Unternehmensimmobilien

Market Report No. 5 by the Initiative Unternehmensimmobilien

Investors shift their focus increasingly to Unternehmensimmobilien

The investment market for “Unternehmensimmobilien” – the German term for multi-use and multi-let commercial real estate – has sustained its upward trend: Transactions in this asset class added up to a total of nearly 775 million euros by mid-year 2016. This tops the prior-year figure by around 27 percent.

The Investment Market in H1 2016: Which Asset Types were Traded?

Demand was strongest for light manufacturing properties. Nearly 260 million euros were invested in this category during the first six months of 2016. It is the equivalent of around 33.5 percent of the transaction total this year to date. Roughly one in four Unternehmensimmobilien assets that were traded represents a converted property, with the term referring to properties revitalised and converted for commercial use. Accounting for a turnover of c. 196 million euros, converted properties were the category that attracted the second-highest demand in H1 2016. Dr. Wulf Meinel, CEO Geneba Properties, Netherlands: “Manufacturing companies show an increasing awareness that their core competence is to manufacture a given product and not the development and management of the real property where the product is made. This trend is matched by the growing interest among professional real estate investors to invest specifically in light manufacturing properties. They have lent more weight to this new asset class.”

Who Buys, and Who Sells, Unternehmensimmobilien?

The group with the largest volume of disposals during the first half-year of 2016 consisted once again of property developers and builders. Between them, they sold 331 million euros worth of Unternehmensimmobilien assets. Institutional funds were once again the dominant buyer group. They spent more or less the same amount on Unternehmensimmobilien assets as last year, c. 319 million euros. This suggests that Unternehmensimmobilien are increasingly held in fund structures, and that they are gradually becoming an established asset class.

German operators have continued to expand their market share on the transaction market for Unternehmensimmobilien. On the buyer side, their share rose from 72 percent during the first six months of 2015 to 85 percent during the same period in 2016. The increased information density in the Unternehmensimmobilien market as well as the low rates of return in established asset classes have apparently prompted more and more German investors to shift their focus toward Unternehmensimmobilien. Overall, they spent 685 million euros on Unternehmensimmobilien during the first half-year of 2016. Cross-border investors were much less active, accounting for a total of barely 120 million euros. The most plausible reason to explain this is that German asset managers and investors are better networked with small and medium-sized enterprises (SME), on the one hand, and that they find it easier to obtain regional market intelligence, on the other hand. This is also apparent on the seller side, where the dominance of domestic players is growing as well, for the same reasons. Their share rose from 81 percent in H2 2015 to 88 percent by the end of H1 2016.

Yields declined in reverse proportion to growing demand. In fact, they hardened in every category during the first six months of 2016. Converted properties registered the fastest deterioration of yields, dropping from 8.4 percent during the first half-year of 2015 down to an average of 6.2 percent by mid-year 2016. Inversely, the most moderate yield compression was registered for light manufacturing properties, as the average yield equalled 8.4 percent during H1 2016. Across all Unternehmensimmobilien categories, the average yield declined by 70 basis points and equals 8.2 percent in 2016 to date.

Flex-Space Units Fall Short of Demand

The flex-space type of unit permits easy adjustments to the floor plan structure to suit bespoke occupier needs. It is particularly sought among commercial tenants in Germany's metro regions. Premises of this type are in short supply while construction activity in this segment is comparatively low. As a result, average rents have gone up by 42 percent to now 8.60 euros/sqm. The main target groups for this type of property include retail companies and business service providers. But they are also rented by creative-media professionals, manufacturing industry, and software/IT companies. Sebastian Blecke, Managing Director of GSG Berlin: “In Berlin, we are currently aware of two tendencies. For one thing, it is the first time that we are seeing a rent level of 20.00 euros/sqm and more for flex-space units in central locations. Secondly, we are witnessing a strong increase in the demand for commercial floor space in remoter locations on the urban periphery. Given the current occupancy rates, even large-scale operations could still relocate here. Because of the short supply of land, this is not or rarely an option for occupiers in the inner city anymore who wish to expand.”

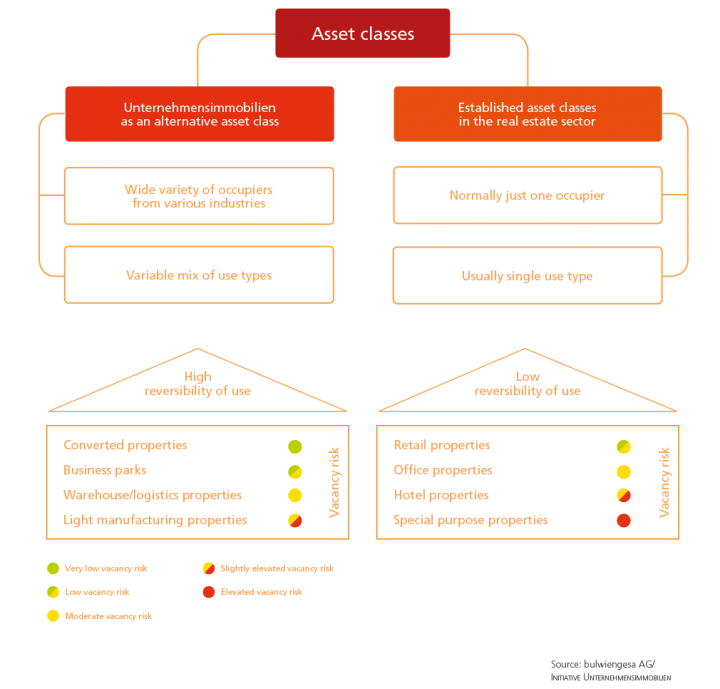

About the Initiative Unternehmensimmobilien

At the moment, the Initiative Unternehmensimmobilien consists of thirteen market operators. Their joint goal is to enhance the transparency in the market segment in order to facilitate access to this asset class. For this purpose, a reporting system was set up in collaboration with the independent research and consultancy firm of bulwiengesa, which evaluated all of the transaction and letting data made available by the members. With the publication of its market reports, the Initiative Unternehmensimmobilien contributes to the ongoing effort of enhancing transparency, and of familiarising a wider audience with this heterogeneous property type. At the same time, it makes the fundamental ratios it identified available to experts and players active in this specific market. Another goal of the initiative is to encourage SMEs and industrial companies to seek closer integration into the real estate market with their property holdings.

The INITIATIVE UNTERNEHMENSIMMOBILIEN continues to evolve. Visit us on the internet at unternehmensimmobilien.net to stay up to date.

Contact: Tobias Kassner, kassner [at] bulwiengesa.de, Phone +49 (0)40 - 4232 2220